extended child tax credit payments 2022

Incentives depend on the HERS score and the classification. To access your free listing please call 1833467-7270 to verify youre the business owner or authorized representative.

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

With six advance monthly child tax credit checks sent out last year only one payment is left.

. Moreover in the second half of 2021 it became possible to. Visit ChildTaxCreditgov for details. Family Security Act and possible 350.

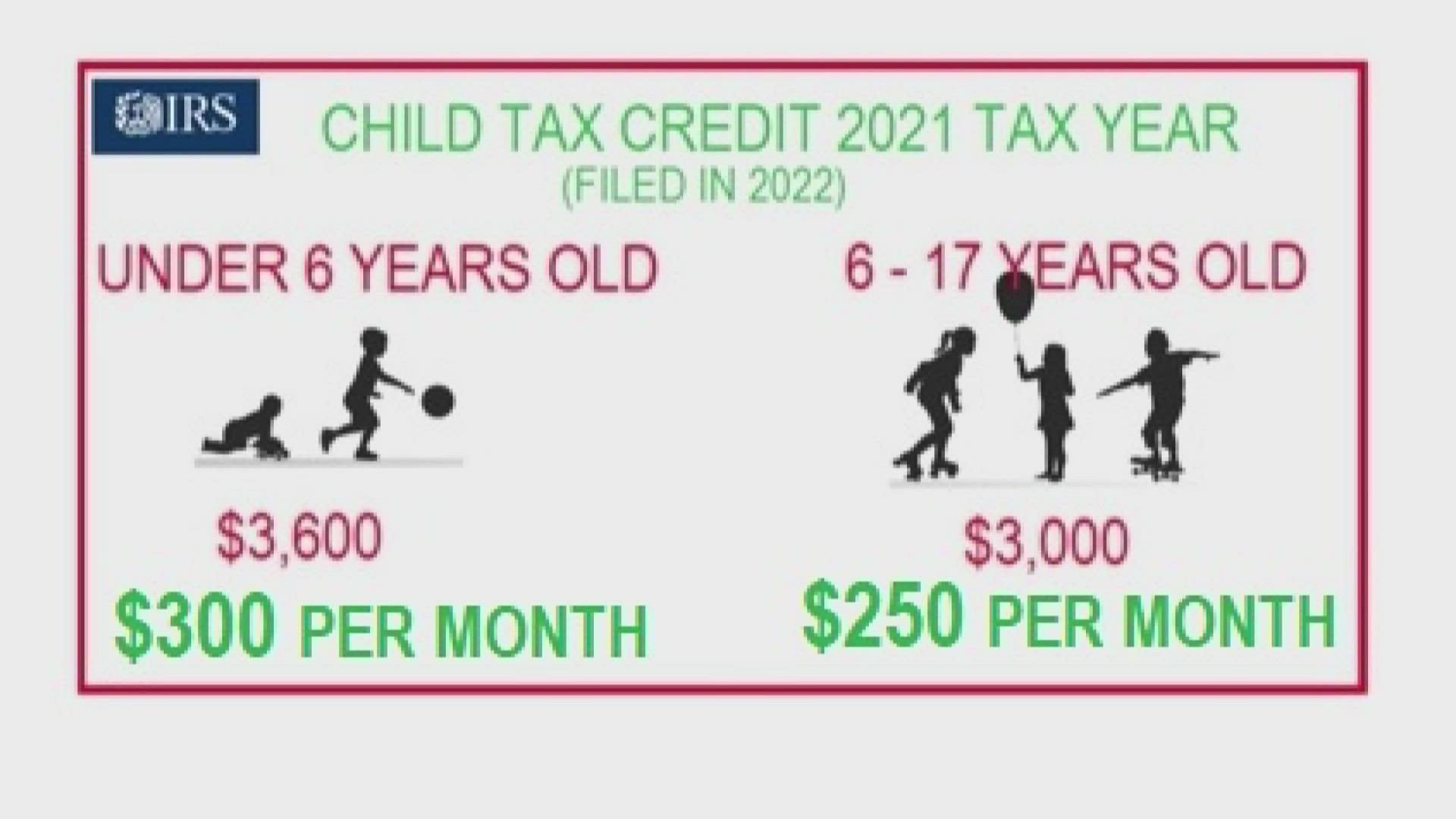

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. NJ Clean Energy- Residential New Construction Program. Tax Pros Income Tax Service 213 Park Ave Plainfield NJ.

Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec. Advance Child Tax Credit Payments in 2021. It hasnt been extended through 2021 and as of Jan.

The Child Tax Credit was born from the Economic Rescue Plan to support working families. Child Tax Credit in 2022. The Township of Piscataway has extended the grace period to August.

Tax Credits 45 Knightsbridge Rd Ste 22 Piscataway NJ. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. But others are still.

3 rd quarter 2022 taxes are due on August 1 2022. This final installment which arrives with your tax refund. After the advanced payment greatly helped families many are asking for advanced payments again.

31 2022 in his Build Back Better plan. Whats more in the second half of 2021 it became possible to receive the Child Tax Credit payments on a monthly basis before receiving the second half of it as a lump sum. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax.

Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. Clifford Colby 172022. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022.

Tweaking the legislation to shore up votes like Manchins could delay passage into the new year meaning families may start 2022 without a firm plan for child tax credit. However Republican Senators Mitt Romney Richard Burr and Steve. Every precaution is being considered during the Covid-19 pandemic.

Tax Pros Income Tax Service 441 North Ave Dunellen NJ. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. 2000 per child in the form of a tax refund instead of.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. 2 June 2022 - Updated on 19 September 2022. 1 2022 the child tax credit reverted to what it was originally.

Child Tax Credit 2022 How Much Will You Get

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Will Monthly Child Tax Credit Payments Continue In 2022 Their Future Rests On Biden S Build Back Better Bill

Child Tax Credit Here S What To Know For 2022 Bankrate

/cdn.vox-cdn.com/uploads/chorus_image/image/70051134/1235261204.0.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Here S What Has To Happen For Child Tax Credit Payments To Continue In 2022 Wjhl Tri Cities News Weather

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 13newsnow Com

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit 2022 Survey Families Struggle Afford Basic Goods After Expiration

3600 Child Tax Credit Payment Update Child Tax Credit Ended Or Extended Until 2022 Youtube

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Child Tax Credit Is December The Last Monthly Payment Will They Be Extended Into 2022 Al Com

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

The 2021 Child Tax Credit Implications For Health Health Affairs